Contact Centers in Banks and Financial Institutions: A Valuable Role

by Erina Suzuki | Published On February 3, 2022 | Last Updated March 6, 2025

![GettyImages-1138580533 [Converted]01](https://computer-talk.com/images/default-source/animations/gettyimages-1138580533-converted-01.png?sfvrsn=735a6899_1)

Financial institutions have been pioneers in the adoption of contact centers to service their clients and provide personalized experiences.

If you’ve ever called your bank or credit card provider before, you likely know the importance of having a great call center experience. Banks and other financial institutions can deliver a vast amount of services and support through the phone without ever having to interact with clients in-person.

But it’s not just through the phone anymore. These days, the opportunity for banks to interact with their customers spans multiple channels, including phone, email, live chat, and more. A survey from Deloitte found that 84% of customers use online banking and 72% use mobile banking apps.

Read on to learn about contact centers in the financial industry and how new technology can help improve the customer experience.

What is a banking contact center?

A banking contact center provides customers with a way to do their banking through different channels, such as telephone banking, live chat and mobile apps.

These contact centers can handle many services that you would typically do at a bank branch, such as paying bills, checking account balances, transferring funds, and more. They also deal with customer support issues, such as opening a new account or reporting a lost credit card.

Banking contact centers are hosted on complex software platforms with many features and integrations. For example, incoming calls are usually routed to an IVR (interactive voice response) system, which provides different banking options without needing to speak to a live agent.

The customer experience for these contact centers is very important. According to PricewaterhouseCoopers, three out of four banking customers say their contact center experience influences their purchasing decisions.

How to optimize your banking contact center

Customers have come to expect full service through contact centers without losing the personal touch that banks have traditionally provided in-person. Thankfully, modern contact center solutions enable these customer experiences.

Consider these few ways to ensure each client gets the best experience possible from your banking contact center:

Reach clients on their preferred channels

A variety of digital channels are essential for connecting with your customers, including web chat, social media, and SMS. Some clients might prefer reaching out through a web chat instead of making a call. Omnichannel contact centers allow representatives to interact with customers through multiple channels on a single platform. Having increased ways to reach your organization will increase customer satisfaction since it makes it easier to get assistance when needed.

Make it easy for clients to solve problems themselves

Before customers reach out to support representatives, empower them to handle basic inquiries and transaction activities themselves. Investing in self-service applications like chatbots and self-service IVRs will go a long way. Chatbots can provide 'always on' support at your customers' convenience 24 hours a day and 7 days a week. Self-service IVRs can provide answers to FAQs regarding topics such as banking hours, bill payments, and account balances. Not only do self-service applications resolve issues quickly, but it is cheaper to have customers serve themselves than to speak with a live agent. By implementing self-service, customer representatives are freed from routine tasks and can focus on upselling and complex non-routine inquiries.

Personalize experiences for each client

It’s no secret that consumers love personalized experiences. With a CRM integration, representatives can access comprehensive client profiles to provide personalized advice. This advice may be based on previous behaviour, recent transactions, open and closed tickets, and customer communication preferences. The contact center in a financial institution may be typically seen as a channel for transaction completion, but it doesn’t have to be only that. Providing customized recommendations for the next steps in customers’ financial goals serves as a way to establish lasting relationships.

Listen to your clients’ feedback

Be attentive to your customers' feedback and improve their experiences by better understanding their needs. With multimedia surveys, you can receive feedback on your services to enhance customer experiences and improve business operations through benchmarking satisfaction levels. Banks and financial organizations can identify service gaps and discover growth opportunities to enhance the overall service by acknowledging customers' pain points.

Allow clients to get in touch with the right representative

Put high-touch customers, members, or urgent cases at the front of the queue when calling into your organization. Creating and modifying interaction workflows across multiple communication channels allows organizations to make configuration changes for high-priority clients. Routing clients to the right service channel and representatives reduces the number of unnecessary transfers and improves customer satisfaction.

Give clients peace of mind with credit card security

A customer relationship requires trust, and it's particularly important in financial institutions since sensitive data is involved. Thankfully, clients will not have to worry about sharing their credit card numbers over the phone when making payments. Contact centers that process payments using PCI-compliant cloud services never store any sensitive cardholder data in their environment. This is the case for both self-service and agent-assisted inquiries.

Top trends for financial services and contact centers

Here are a few trends that we’ve noticed at ComputerTalk as financial institutions modernize their contact centers to keep up with shifting customer demands.

Self-service and mobile apps

With clients increasingly turning to online banking and mobile apps, providing self-service options is more important than ever. As it turns out, most consumers are perfectly happy to do their own banking without the assistance of a bank representative. Offering feature-rich mobile apps that allow customers to access banking services 24/7 is crucial for success in today’s digital age. Data gathered from these apps can also be leveraged to develop new products, optimize existing solutions and improve the overall customer experience.

Hyper-personalization

These days, customers have come to expect high levels of personalization from all their service providers, banks included. Personalization is a key element in making the customer feel that they are valued and appreciated, and that they aren’t just another number. According to a recent survey, 72% of banking customers rate personalization as highly important for financial services. By surfacing data on previous interactions and offering tailored financial advice, banks can offer a more personalized experience and increase customer retention rates. Personalization can be further optimized through the use of AI, machine learning and predictive analytics.

Data security and transparency

It’s no secret that banks collect and store a massive amount of customer data. With cyberattacks becoming a more common issue everyday, data security has never been more important to banks and financial institutions. Recent data breaches in the financial services industry show that banks aren’t immune to cyber threats, and customers are rightfully wary of this fact. In order to maintain good client relationships, transparency on how banks collect, store, and protect personal data is a must. Banks should also look to collect zero-party data over third-party and even first-party data. Zero-party data is information voluntarily given by customers, and prioritizing it is one way that banks can establish trust.

Artificial intelligence

The rise in AI tools for contact centers provides the opportunity to increase efficiency, reduce wait times, and free up agents from performing routine tasks so that they can focus on more complex issues. As AI tools such as chatbots become more capable and widely available, this trend will continue to impact banking contact centers as well as the contact center industry as a whole. While AI has already proven to be incredibly useful as a customer service tool, surveys suggest that most consumers still prefer interacting with humans over AI chatbots when given the choice.

Why use ComputerTalk’s contact center solution?

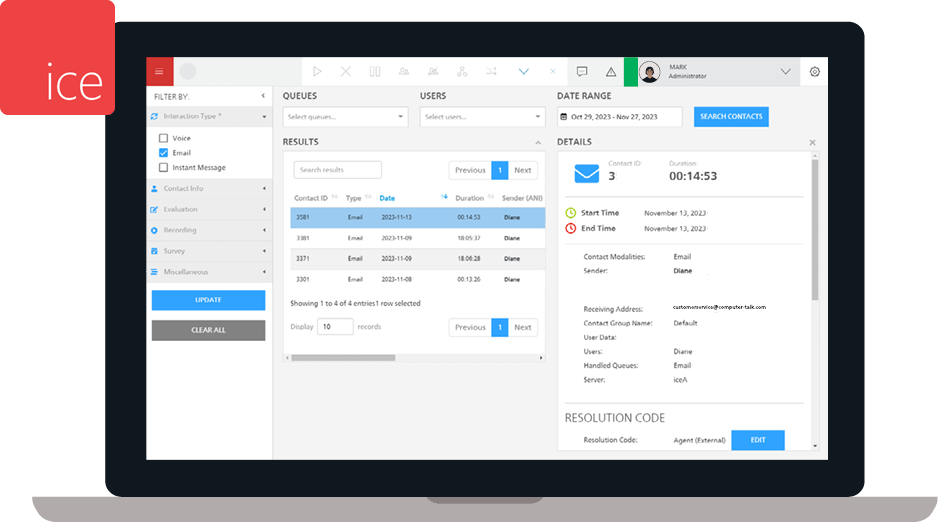

ComputerTalk’s ice solution provides banks and financial institutions with an all-in-one contact center to help deliver outstanding customer experiences. ice modernizes the contact center with business application integrations, AI, and analytics across all communication channels.

Features of ice Contact Center:

- End-to-end security

- Omnichannel platform

- Endless third-party integrations

- Data-driven insights and analytics

- Live monitoring and intelligent routing

- Advanced AI tools

Customer Success Stories

Enhancing Efficiency and Member Experience at Sunshine Coast Credit Union

Sunshine Coast Credit Union (SCCU), a full-service financial institution serving over 17,000 members, previously faced several operational challenges that impacted both agents and customers. Without a structured queue system, customers frequently experienced long wait times and multiple call transfers, while agents struggled with inefficient call handling. SCCU also faced limitations in remote work capabilities, making it difficult to maintain operations during agent absences due to illness or severe weather. Additionally, manual data entry using Microsoft Excel led to inaccuracies in tracking key performance indicators (KPIs).

By implementing ice Contact Center, SCCU transformed its contact center operations:

- Improved Call Handling: The introduction of a structured queue system significantly reduced call transfer rates and ensured that members were quickly connected to the right agent.

- Flexible Remote Work: With ice’s cloud-based capabilities, SCCU enabled its agents to work remotely, ensuring uninterrupted service even during challenging circumstances. Today, 90% of SCCU’s contact center operations are conducted remotely, improving staff retention and efficiency.

- Enhanced Reporting & Analytics: iceReporting provided supervisors with detailed insights into daily operations, including call volumes and agent performance. This allowed SCCU to monitor service levels more accurately and optimize workforce management.

By leveraging ComputerTalk’s ice Contact Center, SCCU improved member satisfaction, optimized agent productivity, and future-proofed their contact center operations.

Improve Customer Satisfaction and Reduce Missed Calls at an Investment Bank

A leading Canadian investment bank with worldwide clients had a phone system where traders were missing calls and customers were erroneously sent to voicemail when other traders were available. The investment bank noticed an increase in customer dissatisfaction, which impacted their client relationships. When the organization decided to work with ComputerTalk, 250 traders with turret terminals started using ice Contact Center. The ice solution allowed all calls to be presented to any available trader during market trading hours. Subsequently, this change drastically reduced the number of missed calls and led to practically all calls being serviced.

Centralized Agent Management to Extend Hours of Operation at a Bank

A banking group operating individually across multiple time zones were not connected through any central network. This caused customers to experience longer wait times as all the phone lines were separated. ice Contact Center helped the bank unite its agents into one virtual queue environment to fully leverage their centralized services. By consolidating the agents’ separate phone lines into a toll-free number, customers can now call in and connect to whichever agent is available first. This allows the contact center to be more accessible, extends their hours of operation, and ultimately elevates the customer experience.

Learn more about our customer success stories and use cases here.

Summary

Authentication is an essential part of any security and compliance strategy in modern call centers. It helps to ensure you can protect the data of your customers, fight back against rising instances of fraud, and protect your brand’s reputation.

Contact centers play a huge role in facilitating customer service for financial services organizations. By using modern software solutions, banks and financial institutions can provide exceptional service to their clients, increase customer satisfaction, and boost loyalty to their organization.

ComputerTalk’s ice Contact Center is one solution that is trusted by leading banks, credit unions and other financial organizations across North America.

To learn more about ice Contact Center or to schedule a demo, click here.

More from our blog

Think AI in customer service is just for retail companies? Think again. With artificial intelligence, educators can deliver better student and customer support at scale, while reducing costs. It’s a win-win for everyone. As AI becomes more versatile, sophisticated, and...

Think AI in customer service is just for retail companies? Think again. With artificial intelligence, educators can deliver better student and customer support at scale, while reducing costs. It’s a win-win for everyone. As AI becomes more versatile, sophisticated, and...

By choosing a Microsoft Teams Certified Contact Center, your organization can expect valuable features and capabilities for better performance and customer experiences.

By choosing a Microsoft Teams Certified Contact Center, your organization can expect valuable features and capabilities for better performance and customer experiences.

Discover 10 clear ways to solve customer issues on the first call. Cut costs, save time, and keep people coming back to your business.

Discover 10 clear ways to solve customer issues on the first call. Cut costs, save time, and keep people coming back to your business.